motorcarman

Compulsive Collector

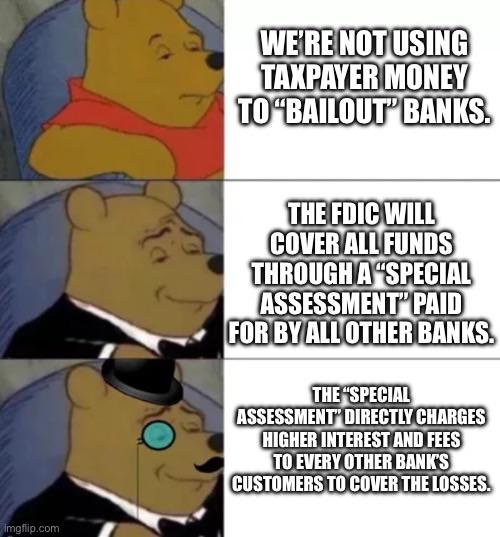

Apparently they are WOKE banks following idiotic policies?

nypost.com

nypost.com

While Silicon Valley Bank collapsed, top executive pushed ‘woke’ programs

“These banks are badly run because everybody is focused on diversity and all of the woke issues and not concentrating on the one thing they should, which is, shareholder returns,” Marcu…

.png)

.png)