WSJ

Gun Maker Remington Plans to File for Bankruptcy Protection

Volatile sales, debt load hobbled Cerberus’s attempt to build a firearms-and-ammunition behemoth

A Remington production facility during World War II. Founded in 1816, Remington is one of America’s oldest and largest gun-and-ammunition manufacturers. Photo: Bettmann Archive/Getty Images

By

Lillian Rizzo and

Sharon Terlep

Updated March 13, 2018 11:20 a.m. ET

215 COMMENTS

A gun maker that Cerberus Capital Management LP spent more than a decade building into an industry giant is now on the brink of failure.

Crushed by a hefty debt load that has gotten harder to manage as gun sales have become increasingly volatile—in part due to the recurring national debate on gun regulations—Remington Outdoor Co. is planning to file for bankruptcy protection as early as March 18.

The Madison, N.C.-based company is expected to restructure its debt and pass into the hands of bondholders, including Franklin Resources Inc. and JPMorgan Chase & Co.’s asset-management division. These creditors plan to offload the asset to another buyer as soon as they can do so profitably, a person familiar with the matter said.

Remington’s new owners will have to contend with a fraught political and social environment. The Feb. 14 school shooting in Parkland, Fla. that killed 17 people spurred a social-media movement demanding greater gun control. Many big investors and companies are reconsidering their ties to the gun industry. Retailers including Walmart Inc. have committed to raise the minimum age for buying a gun to 21 years. Florida last week enacted a law banning adults under 21 from buying firearms, and the White House has released a school-safety plan.

At the same time, gun sales are down, indicating that gun buyers aren’t rushing to stock up in anticipation of stricter gun regulations. Gun makers’ fortunes tend to rise and fall depending on who is in the White House, analysts say. Gun sales rose in the years that Barack Obama was in office because people feared greater gun control. Demand has plummeted since President Donald Trump took office.

In Remington’s case, these ups and downs hobbled Cerberus’s attempt to build a firearms-and-ammunition behemoth, making its nearly $1 billion debt pile insurmountable.

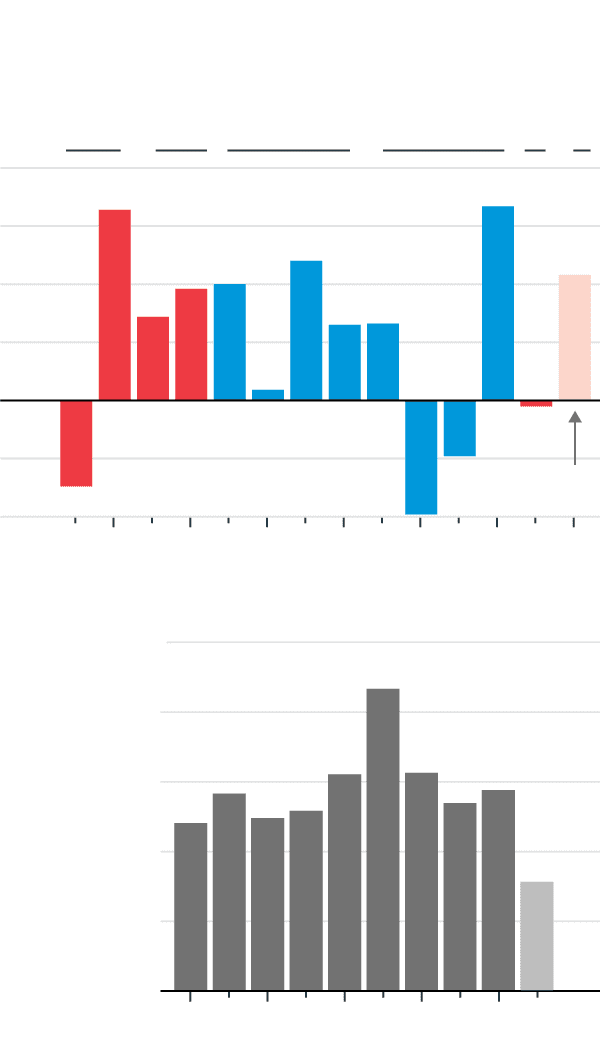

The Politics of Gun Sales

The firearm and ammunition industry's revenue often rises and falls depending on which party is in the White House.

Annual change in gun and ammunition industry revenue

PRESIDENTIAL PARTY

D

R

R

20%

15

10

5

0

–5

Estimate

–10

’14

’08

’12

’10

2006

’18

’16

$1.5

Remington annual revenue

in billions

1.2

0.9

0.6

0.3

0

’12

’10

’08

’14

’16

’17*

*FY17 not yet reported; 9 months ended Oct. 31 Note: Industry revenue based on constant 2018 dollars.

Sources: IBISWorld; Remington public filings

Cerberus entered the firearms business with its 2006 purchase of Bushmaster Firearms International. The following year, the buyout firm paid $118 million for Remington and assumed $252 million of its debt. Founded in 1816, Remington is one of America’s oldest and largest gun and ammunitions manufacturers, whose namesake weapons are mainstays in hunting, shooting sports, law enforcement and the military.

Bushmaster and Remington became the linchpins of a holding company that Cerberus named Freedom Group Inc. The New York buyout firm set out to streamline operations and modernize plants, buying up related assets to create a bigger, more diverse gun company.

By 2010, when Freedom Group filed for an initial public offering, it owned several firearms and ammunition brands and had taken on substantial loans to fund growth, expecting that sales would continue to climb as it wooed new buyers such as women and expanded globally.

A year later, the company pulled its plan to go public, and signs of cracks began to appear. Cerberus struggled to find a chief executive for Remington with the particular skills required to oversee the overhaul of gun-and-ammunition factories.

Quirks of gun manufacturing complicated efforts to overhaul the company’s outdated operations. For instance, Cerberus executives were stunned to learn it would take two years to replace a major piece of equipment used to make ammunition because the machine had gone out of production, the person said.

In December 2012, a gunman entered Sandy Hook Elementary School in Newtown, Conn. and killed 20 students and six staff members. The shooter, Adam Lanza, had used a Bushmaster AR-15 rifle.

Cerberus changed Freedom Group’s name to Remington, and came under intense pressure from its investors and the public. The family members of Newtown victims brought a wrongful-death lawsuit against the company. The case is still ongoing.

Cerberus tried to sell the business. In 2015 it gave investors the option to sell their stakes, moving Remington into a separate vehicle. About half of those investors sold their stakes, the person familiar with the matter said.

A Remington production facility in 1917. Photo: Bettmann Archive/Getty Images

Remington saw a surge in sales leading up to the 2016 presidential election when Hillary Clinton was widely expected to win. The company had spent more than $100 million to upgrade facilities.

Following Mr. Trump’s victory, gun sales slumped. Executives had both overestimated demand during the Obama boom and underestimated the cooling effect of a Trump presidency on sales, the person said.

While gun-industry sales have dropped, they still remain robust, said Steve Dyer, firearms industry analyst for Minneapolis investment firm Craig-Hallum Capital Group LLC. “It’s just that everyone was coming from a place of too much inventory and too much capacity,” he said.

Remington announced its plans to file for bankruptcy protection two days before the Parkland, Fla., shooting. The current political environment could affect its ability to secure a bankruptcy loan, or lead to a higher interest rate, the person familiar with the matter said. This loan, which Remington said it expected would be $100 million, would be used to keep the company afloat under bankruptcy protection.

—Soma Biswas contributed to this article.

Gun Maker Remington Plans to File for Bankruptcy Protection

Volatile sales, debt load hobbled Cerberus’s attempt to build a firearms-and-ammunition behemoth

A Remington production facility during World War II. Founded in 1816, Remington is one of America’s oldest and largest gun-and-ammunition manufacturers. Photo: Bettmann Archive/Getty Images

By

Lillian Rizzo and

Sharon Terlep

Updated March 13, 2018 11:20 a.m. ET

215 COMMENTS

A gun maker that Cerberus Capital Management LP spent more than a decade building into an industry giant is now on the brink of failure.

Crushed by a hefty debt load that has gotten harder to manage as gun sales have become increasingly volatile—in part due to the recurring national debate on gun regulations—Remington Outdoor Co. is planning to file for bankruptcy protection as early as March 18.

The Madison, N.C.-based company is expected to restructure its debt and pass into the hands of bondholders, including Franklin Resources Inc. and JPMorgan Chase & Co.’s asset-management division. These creditors plan to offload the asset to another buyer as soon as they can do so profitably, a person familiar with the matter said.

Remington’s new owners will have to contend with a fraught political and social environment. The Feb. 14 school shooting in Parkland, Fla. that killed 17 people spurred a social-media movement demanding greater gun control. Many big investors and companies are reconsidering their ties to the gun industry. Retailers including Walmart Inc. have committed to raise the minimum age for buying a gun to 21 years. Florida last week enacted a law banning adults under 21 from buying firearms, and the White House has released a school-safety plan.

At the same time, gun sales are down, indicating that gun buyers aren’t rushing to stock up in anticipation of stricter gun regulations. Gun makers’ fortunes tend to rise and fall depending on who is in the White House, analysts say. Gun sales rose in the years that Barack Obama was in office because people feared greater gun control. Demand has plummeted since President Donald Trump took office.

In Remington’s case, these ups and downs hobbled Cerberus’s attempt to build a firearms-and-ammunition behemoth, making its nearly $1 billion debt pile insurmountable.

The Politics of Gun Sales

The firearm and ammunition industry's revenue often rises and falls depending on which party is in the White House.

Annual change in gun and ammunition industry revenue

PRESIDENTIAL PARTY

D

R

R

20%

15

10

5

0

–5

Estimate

–10

’14

’08

’12

’10

2006

’18

’16

$1.5

Remington annual revenue

in billions

1.2

0.9

0.6

0.3

0

’12

’10

’08

’14

’16

’17*

*FY17 not yet reported; 9 months ended Oct. 31 Note: Industry revenue based on constant 2018 dollars.

Sources: IBISWorld; Remington public filings

Cerberus entered the firearms business with its 2006 purchase of Bushmaster Firearms International. The following year, the buyout firm paid $118 million for Remington and assumed $252 million of its debt. Founded in 1816, Remington is one of America’s oldest and largest gun and ammunitions manufacturers, whose namesake weapons are mainstays in hunting, shooting sports, law enforcement and the military.

Bushmaster and Remington became the linchpins of a holding company that Cerberus named Freedom Group Inc. The New York buyout firm set out to streamline operations and modernize plants, buying up related assets to create a bigger, more diverse gun company.

By 2010, when Freedom Group filed for an initial public offering, it owned several firearms and ammunition brands and had taken on substantial loans to fund growth, expecting that sales would continue to climb as it wooed new buyers such as women and expanded globally.

A year later, the company pulled its plan to go public, and signs of cracks began to appear. Cerberus struggled to find a chief executive for Remington with the particular skills required to oversee the overhaul of gun-and-ammunition factories.

Quirks of gun manufacturing complicated efforts to overhaul the company’s outdated operations. For instance, Cerberus executives were stunned to learn it would take two years to replace a major piece of equipment used to make ammunition because the machine had gone out of production, the person said.

In December 2012, a gunman entered Sandy Hook Elementary School in Newtown, Conn. and killed 20 students and six staff members. The shooter, Adam Lanza, had used a Bushmaster AR-15 rifle.

Cerberus changed Freedom Group’s name to Remington, and came under intense pressure from its investors and the public. The family members of Newtown victims brought a wrongful-death lawsuit against the company. The case is still ongoing.

Cerberus tried to sell the business. In 2015 it gave investors the option to sell their stakes, moving Remington into a separate vehicle. About half of those investors sold their stakes, the person familiar with the matter said.

A Remington production facility in 1917. Photo: Bettmann Archive/Getty Images

Remington saw a surge in sales leading up to the 2016 presidential election when Hillary Clinton was widely expected to win. The company had spent more than $100 million to upgrade facilities.

Following Mr. Trump’s victory, gun sales slumped. Executives had both overestimated demand during the Obama boom and underestimated the cooling effect of a Trump presidency on sales, the person said.

While gun-industry sales have dropped, they still remain robust, said Steve Dyer, firearms industry analyst for Minneapolis investment firm Craig-Hallum Capital Group LLC. “It’s just that everyone was coming from a place of too much inventory and too much capacity,” he said.

Remington announced its plans to file for bankruptcy protection two days before the Parkland, Fla., shooting. The current political environment could affect its ability to secure a bankruptcy loan, or lead to a higher interest rate, the person familiar with the matter said. This loan, which Remington said it expected would be $100 million, would be used to keep the company afloat under bankruptcy protection.

—Soma Biswas contributed to this article.