You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So, Admit It, You Want 87,000 More IRS Agents

- Thread starter gdr_11

- Start date

The #1 community for Gun Owners in Texas

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

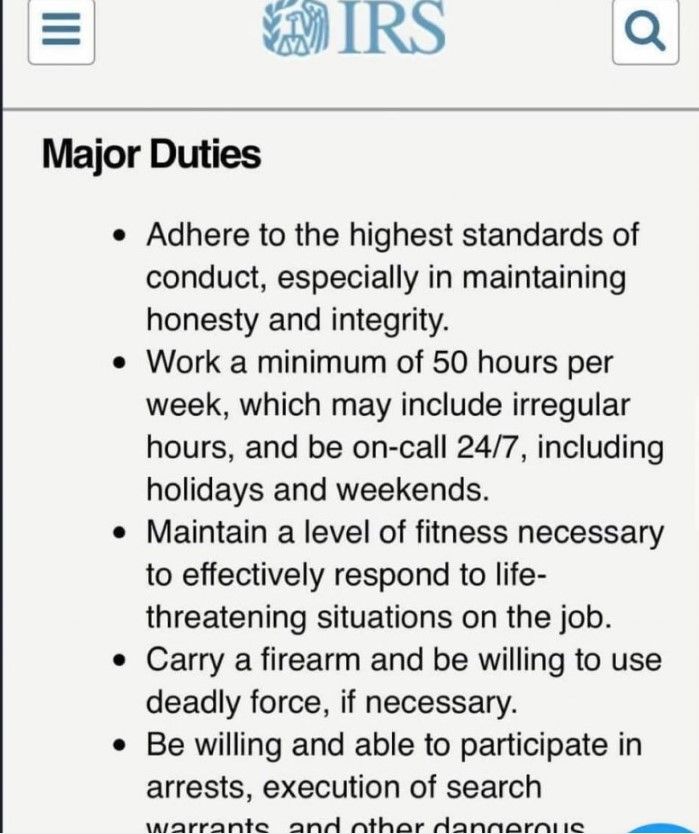

For anyone who still thinks we have "nothing to worry about" and this is all overblown, can someone remind me when IRS agents were expected to carry a firearm, execute warrants, and use "deadly force, if necessary" in their duties as a tax agent?

Wake up people. This is a huge overstep by the Biden administration and it needs to be stopped. The GOP will likely retake the house this year and they need to put a stop to shit like this. Getting tired of Republicans "Playing nice" and trying to be moderate.

This is not the time to be moderate, it's time to put at stop to shit like this.

Wake up people. This is a huge overstep by the Biden administration and it needs to be stopped. The GOP will likely retake the house this year and they need to put a stop to shit like this. Getting tired of Republicans "Playing nice" and trying to be moderate.

This is not the time to be moderate, it's time to put at stop to shit like this.

Train them for what exactly? These aren't accountants they're looking for.I've taken a step back and tried to logic my way through the news headlines about all this. Something didn't add up. There's no way the IRS can bring on 87,000 new employees in any of the core positions. They don't have the ability to train more than about 10,000 a year, at best. That 87,000 must include support staff and be spread over some years in the future.

So I did a little looking and found a couple of places (mostly the WSJ) with a bit more information. The money, $80B, is scheduled to be metered into the IRS over the next 9 years. The hiring will, presumably, take place over that same time period. This works out to about a 45% increase in yearly budget for the agency.

In 1995, the agency employed over 117K people. Since then, it's been very politically popular to beat up on the agency. Nothing fits into a stump speech better than "Kill the IRS!" As a result, by 2021, budget cuts had brought total agency employment down to just over 81K people.

Lessee...the economy has gotten bigger, the population has gotten bigger, everyone but especially tax cheats have gotten more sophisticated, etc., while we let the agency that's supposed to enforce tax law shrink by about 30% during a period when the GDP essentially tripled. Now some money is going back into the agency to do lots of things, including hiring 10s of 1000s of new people, all while many, many 1000s of current employees are retiring.

Nobody likes the IRS; I get that. But it looks to me like, even if this thing passes, the IRS will never in my lifetime be as strong as it was 25 or 30 years ago.

We all lived through that, didn't we?

Revenue Agents, the job most people are thinking of when they say "Agent", don't. They are civil examiners.can someone remind me when IRS agents were expected to carry a firearm, execute warrants, and use "deadly force, if necessary" in their duties as a tax agent?

Special Agents can do all those things because they are criminal law enforcement officers. In normal practice, Special Agents in the IRS Criminal Investigation Division never do any of those things unless the LEOs of another agency enter first, make sure everything is clear, and that the IRS SAs can proceed safely.

Truthfully, the most common time carrying a gun and the willingness to use deadly force come into play for IRS Special Agents of any sort is when some nut job shows up at an office and either threatens to cause or begins action that will result in injuries. Even then, the Special Agents whose primary job it is to provide that protection are from a non-tax division, the Treasury Inspector General. Nevertheless, when someone loses it and starts throwing chairs or goes to their vehicle to retrieve a weapon, any SA nearby is expected to pitch in and help, especially since most buildings housing IRS personnel do not have a Federal Protective Service contingent on the premises.

Lest you think those threats are no big deal, I'd remind you that when the IRS Service Center in Austin was re-roofed in the early 1970s, workers found almost a dozen mortars on the roof. The idiots trying to mortar the building weren't using anything explosive but they certainly made their feelings known by poking holes in the roof. Crazy shit like that happens far, far, far more often than the public realizes. Hell, the IRS employees in Austin who were attacked by the nut who flew his plane into the building probably wish they had SAs on the roof with Stingers.

Most SAs who are executing warrants aren't doing anything other than showing up at the CPA offices of suspected criminals who are under investigation where they stop operations and take records. They'll tag along with any other LEOs who think a tax crime might come to notice in the course of an investigation, e.g. when drug dealers are busted with large amounts of cash. Even in those cases, the Special Agents will often keep a regular Revenue Agent on standby to actually do the work of terminating the tax year of the suspected drug dealer and assessing the proper amount of income tax.

The only time SAs must consistently treat the world as a dangerous place and maneuver through it armed and prepared to use deadly force is when they're on a protective detail. TIGTA SAs are assigned that duty when any IRS employee comes under a credible death threat. They also have two SAs protecting the Commissioner of the IRS at all times.

Is that enough of a reminder?

Yes, accountants are absolutely what they're looking for. If the IRS hires 87K more people (and PLEASE keep in mind that this whole thing will probably be shot down as soon as the Republicans take back Congress, before even 10% of that money is spent), most of them will be support positions. Civil enforcement (Revenue Agents, Tax Compliance Officers, and Revenue Officers, all of whom are generically known as "agents" by the general public) will be the next largest block. After that, a few folks will be Special Agents.Train them for what exactly? These aren't accountants they're looking for.

Currently, there are just barely over 2000 Special Agents at the IRS Criminal Investigation Division. The TIGTA SAs are a much smaller number. Do the math and, absolutely top end, the IRS might be hiring another 2500 Special Agents over the next 9 years while, as with every other position, large numbers of them are simultaneously retiring.

And even those Special Agents with CID are literally accountants. They all have accounting degrees and most are CPAs. I realize that CPAs with guns strikes most people as really weird but sometimes the world is just weird.

As for the Tim Poole stream, the less said the better. The guy has done some great work in the past but he's all too often bloviating about stuff he doesn't understand. That's painfully clear in the video you posted. I got through 10 minutes of it before I gave up. That was about the point that he decried the auditing of Earned Income Credit returns because the EIC is supposed to be something to help low-income folks. He was holding that up as an example of how the IRS persecutes the little guy. The EIC is, however, a much more nuanced situation than he understands; it's the source of so much fraud it beggars belief. Tim doesn't seem to know anything about that yet he lists it, along with lots of other stuff he clearly doesn't understand, to support his outrage against the IRS.

There are plenty of things to be pissed off at the IRS about but EIC audits aren't one of them. I really wish he'd stay in his lane.

Yes, accountants are absolutely what they're looking for. If the IRS hires 87K more people (and PLEASE keep in mind that this whole thing will probably be shot down as soon as the Republicans take back Congress, before even 10% of that money is spent), most of them will be support positions. Civil enforcement (Revenue Agents, Tax Compliance Officers, and Revenue Officers, all of whom are generically known as "agents" by the general public) will be the next largest block. After that, a few folks will be Special Agents.

Currently, there are just barely over 2000 Special Agents at the IRS Criminal Investigation Division. The TIGTA SAs are a much smaller number. Do the math and, absolutely top end, the IRS might be hiring another 2500 Special Agents over the next 9 years while, as with every other position, large numbers of them are simultaneously retiring.

And even those Special Agents with CID are literally accountants. They all have accounting degrees and most are CPAs. I realize that CPAs with guns strikes most people as really weird but sometimes the world is just weird.

As for the Tim Poole stream, the less said the better. The guy has done some great work in the past but he's all too often bloviating about stuff he doesn't understand. That's painfully clear in the video you posted. I got through 10 minutes of it before I gave up. That was about the point that he decried the auditing of Earned Income Credit returns because the EIC is supposed to be something to help low-income folks. He was holding that up as an example of how the IRS persecutes the little guy. The EIC is, however, a much more nuanced situation than he understands; it's the source of so much fraud it beggars belief. Tim doesn't seem to know anything about that yet he lists it, along with lots of other stuff he clearly doesn't understand, to support his outrage against the IRS.

There are plenty of things to be pissed off at the IRS about but EIC audits aren't one of them. I really wish he'd stay in his lane.

I don't know Ben. Something about the IRS stockpiling 5,000,000 rounds of ammo, hiring armed agents, and getting an 87,000 manpower boost still doesn't sit well with me. Especially in light of how Biden is mobilizing the ABC agencies to go after political enemies (just like Obama did).

I hope a Republican congress shuts it down.

I feel the same way but probably for different reasons than you. If the IRS wants to more than double in size, the resources that will have to be diverted from productive work into training will be massive. It takes 5 years to get a Revenue Agent trained to the point where they have an idea what they're doing and can actually start finding enough tax due to make their position a net positive for the agency. It takes the same amount of time for a Revenue Officer. Tax Compliance Officers can start bringing in accounts receivable in about 2 years. SAs in CID cost money, always. Gearing up to double the size of the agency will seriously hamper normal workflows for 2 years, minimum, and more likely 5.Something about the IRS stockpiling 5,000,000 rounds of ammo, hiring armed agents, and getting an 87,000 manpower boost still doesn't sit well with me.

In short, if the IRS goes full bore trying to implement this, their effectiveness will go in the toilet for years.

However, the IRS has had stuff like this dangled in front of them before and they know it's highly likely that the next Congressional swing will take it all away. That means they'll be very reticent to do things like acquire new office space. They'll set themselves up for a slow build-up to using the money. Congress will see a very slow, very poor initial return on investment.

Between the Rs not liking the IRS, the Ds not liking the way the IRS moves too slow to hurt the right people, and the IRS moving cautiously, I truly think this whole thing will flame out in a year or two, four at the most, with damn near nothing to show for it.

While the IRS may have cases where they may investigate dangerous people, their criminal department has always been smaller in size, around 2,000 personnel. there wasn't a need for auditors as a whole to be armed. Now they need 87,000 armed personnel? Sounds to me to be more about intimidation, and intimidation isn't usually used on the higher earners. These are hired thugs.

the IRS will never in my lifetime be as strong as it was 25 or 30 years ago.

We all lived through that, didn't we?

The IRS was fully neutered after Nixon misused the agency. For a quarter of a century, the agency pretty much did it's job without stirring up too much shit.

Then Clinton came along and Al Gore rode herd on the whole "Reinventing Government" initiative. The IRS was an early casualty. It took years for them to get really twisted up but I now consider the agency a lost cause.

Unintended Consequences 2: Electric BoogalooThis is the Biden administration logic; all law abiding citizens should welcome 87,000 more IRS agents instead of Border Patrol or DEA staff.

Cardin: If You Paid Your Taxes, 'You Should Want' to Have 87,000 More IRS Agents

Senator Ben Cardin (D-MD) said on this week's "Fox News Sunday" broadcast that people who pay their taxes should not worry about the Democrats' bill that ramps up enforcement at the IRS. | Clipswww.breitbart.com

A defacto brown shirt squad. I can't believe this isn't more obvious to the general public.While the IRS may have cases where they may investigate dangerous people, their criminal department has always been smaller in size, around 2,000 personnel. there wasn't a need for auditors as a whole to be armed. Now they need 87,000 armed personnel? Sounds to me to be more about intimidation, and intimidation isn't usually used on the higher earners. These are hired thugs.

It is to make up for the unwoke the military purged.While the IRS may have cases where they may investigate dangerous people, their criminal department has always been smaller in size, around 2,000 personnel. there wasn't a need for auditors as a whole to be armed. Now they need 87,000 armed personnel? Sounds to me to be more about intimidation, and intimidation isn't usually used on the higher earners. These are hired thugs.

You have to declare martial law to deploy the military on American soil. That's why states have a national guard.It is to make up for the unwoke the military purged.

No! That's not what the legislation calls for. The legislation would give them a TOTAL of 87,000 new people over the next 9 years. The number of armed Special Agents isn't specified but it will be only a small fraction of that 87,000.Now they need 87,000 armed personnel?

People are confused because every MSM headline I've seen seems deliberately designed to confuse, not inform. Even some of the smaller, usually smarter, news outlets are getting it wrong.

If you're pointing out something that seems contradictory to you, please be clear and I'll try to do the same.

So why does the recruitment state that they must be armed and be able to use deadly force?No! That's not what the legislation calls for. The legislation would give them a TOTAL of 87,000 new people over the next 9 years. The number of armed Special Agents isn't specified but it will be only a small fraction of that 87,000.

People are confused because every MSM headline I've seen seems deliberately designed to confuse, not inform. Even some of the smaller, usually smarter, news outlets are getting it wrong.

I've tried to get on the IRS site, but they must be overloaded or closed their site.

Gimme a link to "the recruitment" and I'll explain it.So why does the recruitment state that they must be armed and be able to use deadly force?

Like I said, I haven't been able to get on it for the last few hours.Gimme a link to "the recruitment" and I'll explain it.

OK.

First, any job announcement open right now has nothing to do with the 87,000 new positions. That legislation hasn't passed yet.

Second, the only 1811 series (Special Agents, the only people who carry badges and guns) jobs available at the IRS right now are here: https://www.usajobs.gov/job/634575800

Third, that announcement came out in February and covers the entirety of 2022.

Fourth, that announcement is for 300 positions, not 87,000.

Fifth, recruiting 300 new SAs a year is just...well...normal. They have people who resign or retire or transfer to other agencies. They fire some. There is a constant need for about that many just to keep staffing level.

I am at a loss as to why anybody is getting their knickers in a twist over any of this.